PE and VC Recruiting Strategies: Tailoring Executive Search for Portfolio Success

In the world of growth and investment, the success of a portfolio company is inextricably tied to the strength of its leadership team. Whether backed by a private equity (PE) firm or a venture capital (VC) fund, the talent at the helm plays a defining role in hitting growth milestones, navigating complex transitions, and delivering returns. Strategic executive search for VC-backed companies and private equity executive recruiting has never been more essential.

Despite value creation being the ultimate end goal for both ownership models, private equity recruiting and venture capital executive search often demand very different leadership styles, experiences, and cultural fits. Let’s explore the key differences between the two, how they impact the leaders needed, and how private equity executive search firms and VC recruiters tailor their approaches.

Structural Differences That Shape Talent Needs

Understanding the underlying structure of PE vs VC investing is often key to building an executive recruiting strategy for portfolio companies.

Time Horizon & Exit Strategy

At the heart of every investment strategy lies a clear expectation of return: how fast, how big, and how it will happen. Understanding the time horizon and exit strategy of the capital partner is foundational to recruiting for private equity or VC-backed businesses.

Private Equity firms typically:

Buy into established businesses, often with a clear path to increased enterprise value through operational improvement, margin expansion, or strategic restructuring

Have relatively short hold periods (often 3–5 years), focused on results and needing executive leaders who can deliver ROI quickly

Common exits include strategic acquisition, secondary buyout, or IPO

Leaders must be able to optimize operations, enhance reporting, and scale profitably in a compressed time frame

Venture Capital funds typically:

Fund early-stage or high-growth startups with significant uncertainty. The time to scale is longer (often 7+ years), and the journey includes multiple funding rounds, pivots, and market experiments

The focus is less on shorter-term profits and more on traction, innovation, and positioning for hyper-growth

Exits typically come through IPO, strategic acquisition, or late-stage funding rounds that bring in crossover or growth equity investors

Leaders must be capable of navigating ambiguity and building toward long-term potential

Governance & Control

The level of investor involvement in a portfolio company significantly shapes the kind of leadership that succeeds. This dynamic influences not just how decisions get made, but also what kind of executive temperament and communication style is needed to thrive.

PE firms often exert significant control through board seats and performance oversight. This means new leadership needs to be board-savvy, operationally rigorous, and comfortable in structured environments. This dynamic makes private equity headhunters especially valuable in sourcing executives who can excel under this governance model.

VC funds, while still involved, tend to provide strategic guidance rather than in-the-weeds management, especially in early-stage startups. Portfolio leaders need to be entrepreneurial, scrappy, and able to lead with limited structure.

Stage of Company

Where a portfolio company sits on the maturity curve dramatically affects the type of leadership it needs. These realities call for very different kinds of leaders, from seasoned operators with scale experience to visionary builders comfortable in ambiguity.

PE portfolios usually consist of later-stage or mature companies with revenue and established market presence.

VC portfolios include early- to mid-stage companies, often still validating product-market fit or entering new markets.

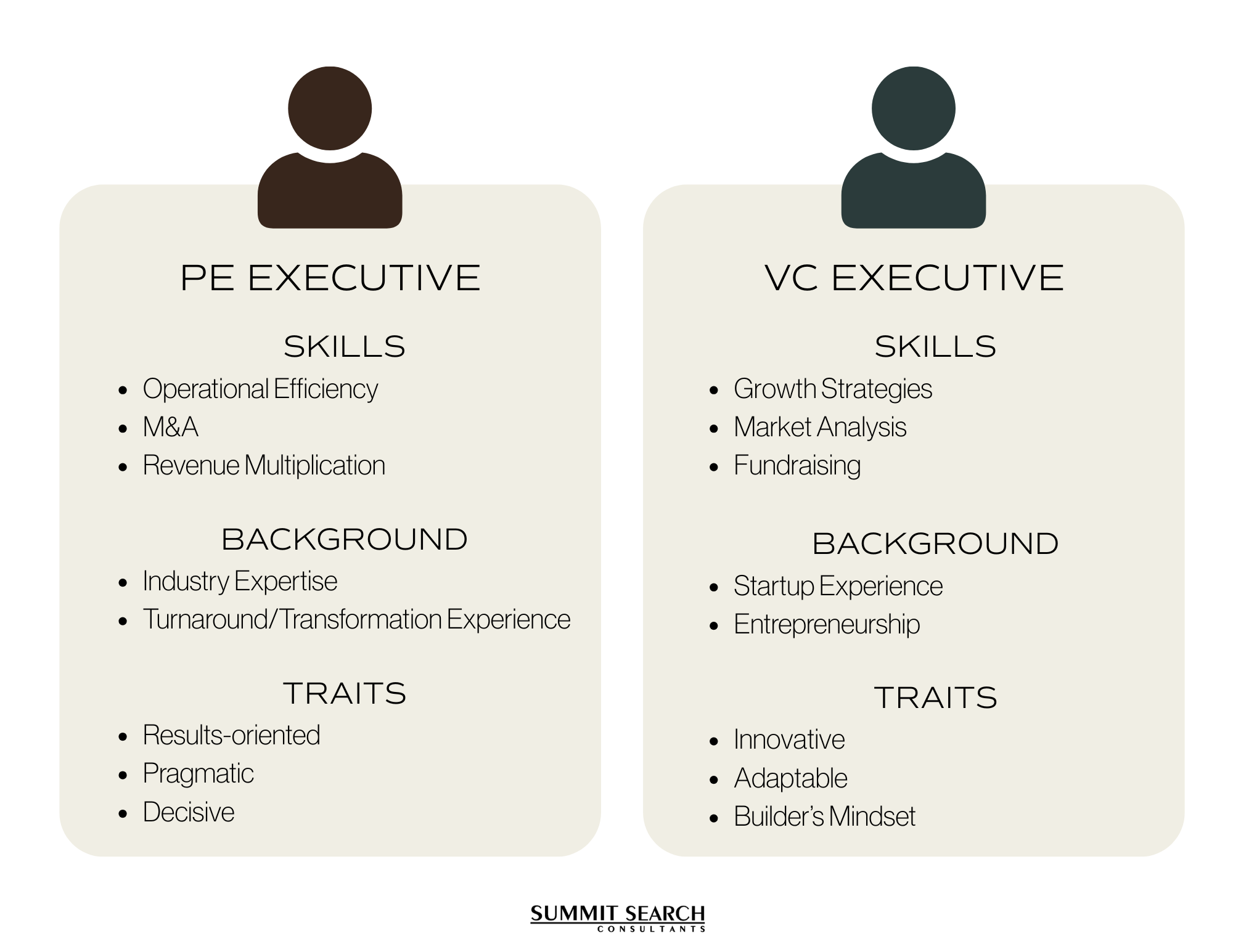

Talent Profiles: What Each Ownership Model Looks For

Private Equity Portfolio Companies

PE investors typically seek seasoned executives who:

Have led successful turnarounds or scaled businesses under performance pressure

Are highly data-driven and performance-oriented

Bring deep experience in operations, finance, or go-to-market execution

Thrive in structured, fast-paced, and high-accountability environments

Are motivated by equity incentives tied to near-term exits

Have prior success in turnaround or value-creation roles, often within other PE environments

CEO, CFO, COO, and CRO are common focus areas, with clear mandates tied to KPIs and exit-readiness. The right PE recruiting firms and executive search firms focused on private equity ensure candidates are execution-ready, not learning on the job.

Venture Capital Portfolio Companies

VC-backed companies often require leadership who:

Can operate in high-ambiguity environments with limited resources

Possess a builder’s mindset, eager to roll up sleeves and create new systems

Align closely with founder vision and culture

Have experience in high-growth, fast-changing, resource-constrained environments

Adapt as companies evolve from Series A through Series C+ stages

Hiring may be more iterative and performed in stages; for example, a founding team might bring in a VP of Product at Series A, and only seek a CPO closer to Series C.

How Executive Search Partners Add Strategic Value

The right retained search firm for private equity operating executives or VC portfolio leaders can play a pivotal role in building high-performing leadership teams. Experienced search partners act as advisors not just in talent acquisition, but also in organizational design and role calibration.

At key inflection points, such as post-acquisition integration for PE-backed businesses or Series C scaling for VC companies, portfolio leadership needs shift. The best private equity recruiting firms for portfolio company leadership clarify the mandate, align compensation with market norms, and ensure roles are structured for success. This is particularly critical in founder-led startups introducing outside executives for the first time.

While private equity recruiting and venture capital recruiting share the common goal of scaling successful businesses, their approaches differ significantly. Aligning recruiting strategies with each model’s unique priorities ensures portfolio companies are led by executives equipped to deliver meaningful, lasting impact.